Award-winning PDF software

Are you trying to apply for the canada pension plan (cpp)?

The application form is no longer available. • send the application form to: CPP / EI Admin/Claims and payees Citizenship and Immigration Canada Attn: Claimant / CPP/EI 1-1135 Jasper Avenue Ottawa ON K1H 8W2 You can also submit an Application Form and one copy to the CPP office nearest to you.

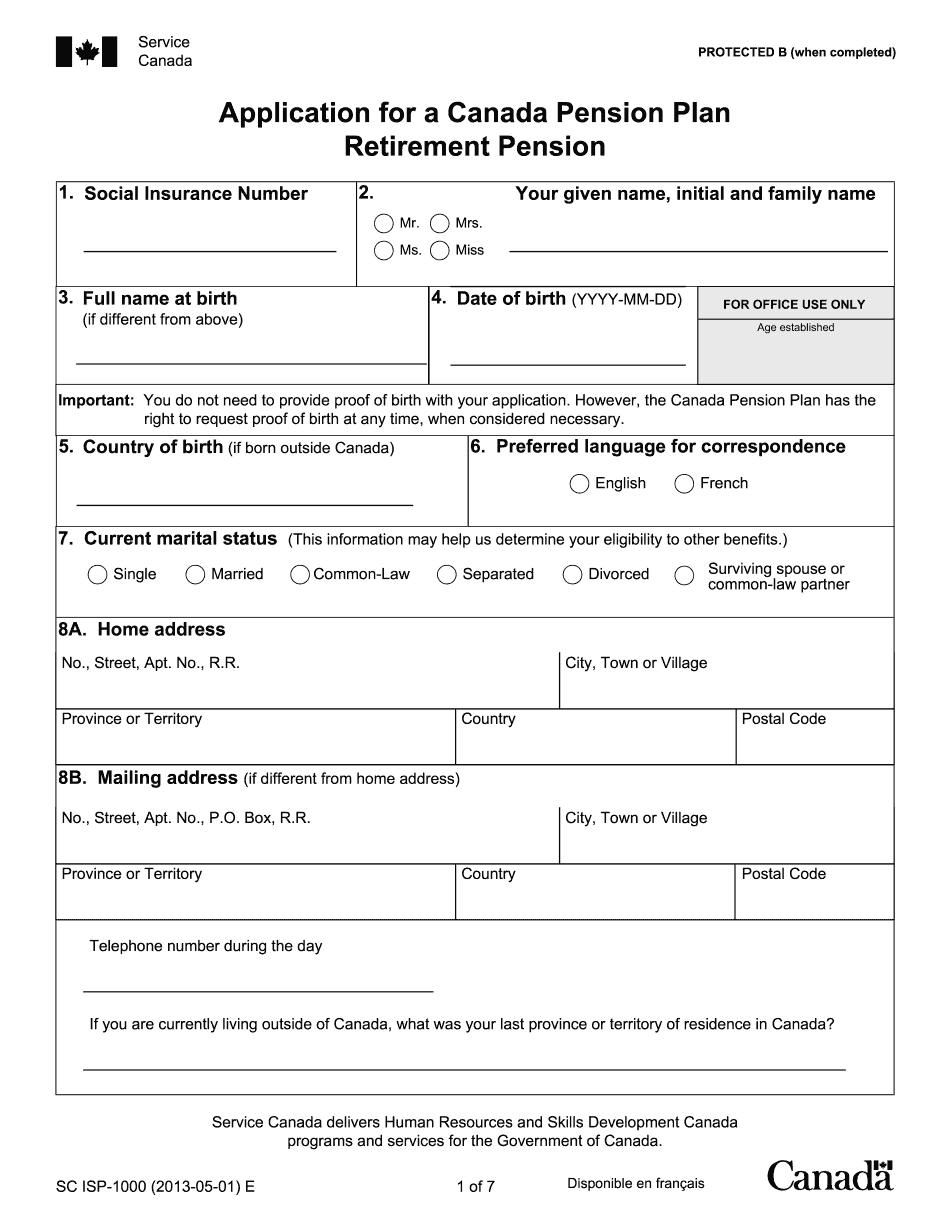

Form isp-1000 "application for a canada pension plan

Once the application has been processed, a letter will be sent to individuals who are under the age of 65 (with appropriate proof), asking for verification of residency in Canada, and providing a description of the type of employment income they are receiving from any employment (including self-employment income). To be eligible for a Canada Pension Plan retirement pension, persons must have been employed continuously for at least the five years before reaching age 65, have worked their entire career to age 65 or will do so within the next five years (whichever comes first). They will also have to have: worked for their employer in any of the types of employment listed on the application before reaching age 65; been enrolled in employment insurance, or a pension plan; or entered into an equivalent program through a union, pension board, labour-management committee or other group or organization. Applying for a.

Application forms cal poly pomona

Please visit our Frequently Asked Questions page for more information. The CPP internship program is also a fantastic opportunity for students who have never held an academic position before! If you are interested in attending the last day of the program and apply the following week (Monday, July 28) you can apply to be on our CPP Internship Application List. If you are on the list please bring your resume and cover letter. If you are interested in an unpaid placement, please call the CPP office at. The internship program is not for everyone; the program is for students who need to experience in the field for a period of at least six months. Candidates must not have prior placement experience from any source or be a current employee in the City. To apply for either the CPP or CSU LA internships please fill out the following: (2) The CPP or CSU LA.

What are the steps to apply for a canada pension plan (cpp)?

Canadians living in EUéBEC will see an additional tax refund of €1, Individuals (not spouses) aged 18 to 64 can claim a Tax credit of € A Quebec resident can claim a Tax credit of €, not including the tax refund received on his/her return. If the amount claimed by the individual is exceeded, then the individual could request an annual adjustment of €50 for each tax year that he/she failed to file. Newly arrived immigrants will also be eligible to claim a tax credit of €, or a Tax credit of €1, if he/she has resided permanently in Canada. Canadian-born individuals who have resided in Canada for three out of the five years preceding the tax year should be able to claim a Tax credit of € An overpayment of the tax credit, which is allowed if the overpayment is less than €5, can only be claimed by the individual. Once.

How to apply for canada pension plan (cpp) retirement

Service Canada will then complete and mail you a retirement pension Certificate. Service Canada will make a payment which you will receive in the mail from the Postal Service or a financial institution of your choice, as the case may be Note that you must keep all receipts and copies of each and every return of payment of pension as this is documentation used to determine whether your pension is payable on retirement from employment. You can send payments to yourself or other beneficiaries on Form ISP5020. You can pay your CPP pension to yourself using Form CPP4010 or Form CPF4010 and give it to your employer. Furthermore, you can also order forms from your financial institution and give them to your employer using Form CRF4010. Furthermore, you can send payouts to a beneficiary by giving them a paper Form CPP4520 and paying into the account using Form CPP4010. Furthermore, you can also choose.